Owe City Taxes? Your Income Tax Refund May be Garnished! By Bob Rodericks

City Warning Letter Brings in $2 million…?

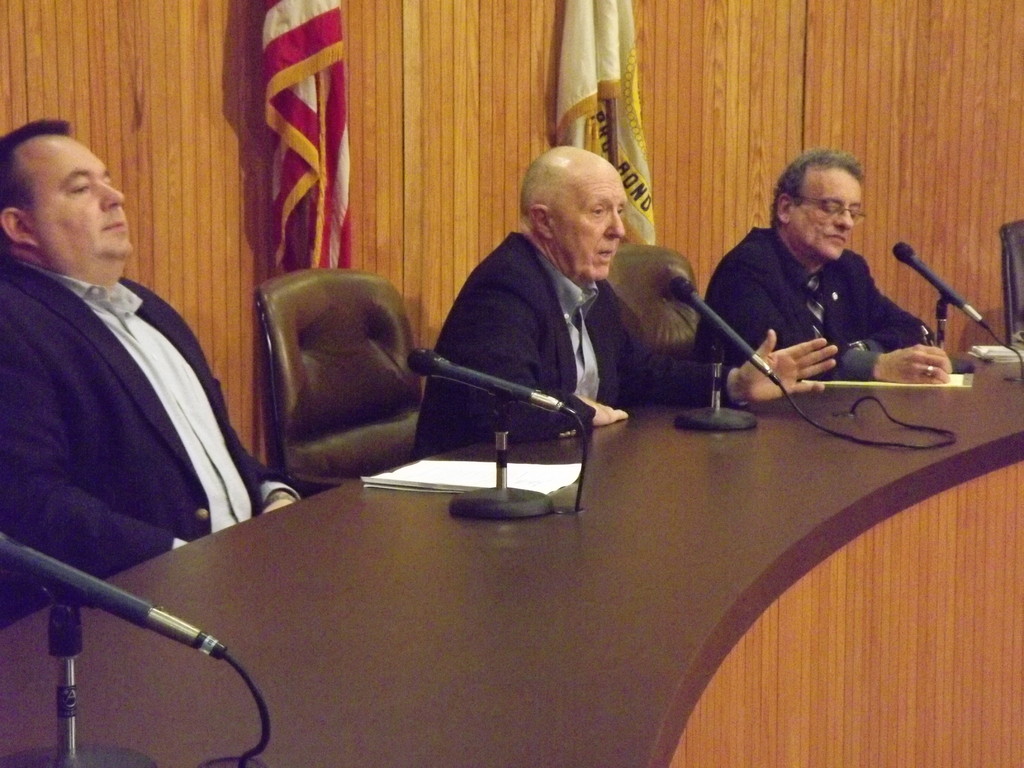

A new state law gives communities the authority to garnish citizen tax returns in order to collect unpaid taxes. The letter which recently went out to residents in arrears on property taxes and water bills may have pushed some people to pay their overdue taxes. Finance Director, Ellen Eggeman told the commission that some “4,000 transactions were recently transpired and the city received $2 million in tax receipts. However we don’t know how much of this was because of the letter we sent out. It was close to tax time and some people had regularly sent in their payment. The $2 million just received included past due property taxes and past due water payments as well as on-time payments,” Eggeman added. The city was at a further loss in trying to tell commission members how much of the $2 million is for water fees versus property tax. “Our computer system won’t let us sort the tax revenue between departments. We just don’t know how much of the money was due to our letter suggesting income tax garnishment for delinquencies or how much was for water collections,” she added. East Providence would be the first city in Rhode Island to use this income tax garnishment to collect unpaid property taxes.

East Providence Tax Information… The Treasury Division collects and processes all tax and water payments. The Division processes over 30,000 tax payments and 60,000 water payments per year. Delinquent motor vehicle and tangible accounts are turned over to a collection agency, Rossi Law Office. The city has expanded its collection efforts to include the acceptance of credit cards in-office as well as online for both tax and water payments. This service has a convenience fee of 2% plus $1.00. Current Tax Rates: Residential Real Estate $10.42 for municipal and $9.67 for schools, with a $20.09 per $1000 tax valuation. Commercial Real Estate breaks down as $11.53 for municipal and $10.72 for schools with a $22.25 per $1000 tax valuation. And tangible of $25.70 for municipal and $23.89 for schools with a $49.59 rate per $1000 tax valuation. Motor Vehicles breakdown with $19.23 for municipal and $17.87 for schools with a $37.10 per $1000 tax valuation. There is no grace period for the payment due dates. The real estate bills are for the current calendar year. The motor vehicle bills are for the prior calendar year. Motor vehicle bills must be current in order to receive clearance to register with the RIDMV. Tax bills are issued by June 1. The tax bill due dates are July 1, September 1, December 1 and March 1. All exemption and valuation questions are handled by the Assessment Division. The tax sale is held annually in April. (Above data from City Treasury Division).

Comments

No comments on this item Please log in to comment by clicking here